Credit Renegotiation

Research

Prototyping

2023

Employer

banQi is the digital account of Casas Bahia. Committed to helping accelerate financial inclusion, making it more accessible, reliable and oriented to low-income Brazilians and their families.

Team

The Renegotiation team handles all credit renegotiation flows within banQi, such as CDC (the booklet of Casas Bahia’s stores), BNPL, personal loan, and credit card.

We were facing a problem of low conversion rates in renegotiations: both in terms of low adherence to the request for a renegotiation and among users who requested the renegotiation, a small portion actually completed the contracting process by paying the first installment.

At the same time, we were also facing an atrocious number of defaults after renegotiation.

In other words, we had fewer renegotiated customers than we would like (high number of defaults on loans, CDC, BNPL) and the renegotiated customers we did have were unable to maintain the renegotiation and ended up defaulting again.

Where is the data?

When I joined the Renegotiation team, the product team had access to the transactional numbers, but there was a need to track the app flow numbers so we could also understand the influence of design in these transactional results. In other words, we wanted to understand whether a design gap was causing this renegotiation flow not to be utilized by our users, or if the problem lay elsewhere, such as in the business rules.

This dilemma led to the need for tagging events and tracking our users' journeys within the app using Amplitude.

Example of part of the flow with the request for event tagging and pageview tracking

Let’s research?

We also opted to conduct research via Maze to validate some interface improvements, understanding that these small changes were also aligned with our goal of improving conversion rates for renegotiation contracting.

To build this research, I built a prototype of our current flow, then built a CSD Matrix with the entire Renegotiation team, and then clustered the questions to assemble a research script and . To assemble the script, I had the help of Thalita Gonçalves as a UX writer and Poliana Santos as a UX researcher.

Our survey was sent to two different bases: users who have already renegotiated via the app and users who are in arrears. From the results collected, we were able to gain a better understanding of the interface gaps in our flow, as well as collect a lot of feedback on the business rules of our product.

Here are some samples of the questionnaire:

Example of questions addressed in the research conducted to understand the interface improvements of the flow

This research consisted of an asynchronous usability test and a questionnaire about the experience with the flow used in the test. And as we can see from the result above, 76% of the participating users understood the message we wanted to convey that it was indeed necessary to pay the first installment of the renegotiation to complete the contracting process. At the same time, in the image below, we can see users choosing between two types of components that allow them to choose the desired number of installments, being a more exploratory part of the questionnaire.

Example of questions addressed in the research conducted to understand the interface improvements of the flow

And in the image below, our third sample of the research conducted, I wanted to bring up how we approached the problem of identifying the renegotiation, given that in a loan and a renegotiation the user takes one amount but pays another. For example: John took out a loan of 300 reais, but the final amount to be paid is 315, which of these values should we use as the main identifier for the loan? And the same question is repeated for renegotiation: the renegotiated amount or the final amount to be paid in the renegotiation?

Example of questions addressed in the research conducted to understand the interface improvements of the flow

Next, I will discuss some of the interface design solutions we implemented, as well as solutions that use experience design to mitigate the pain points that arise from the product's business rules.

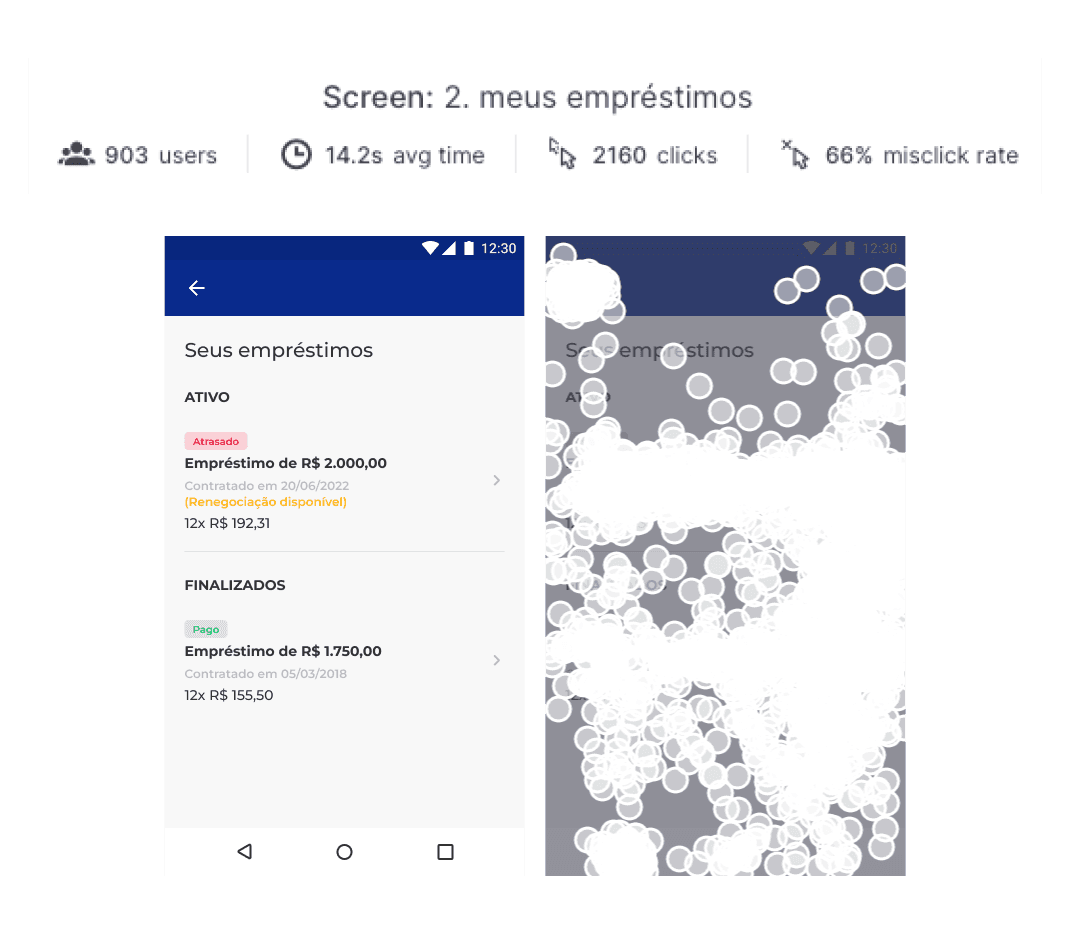

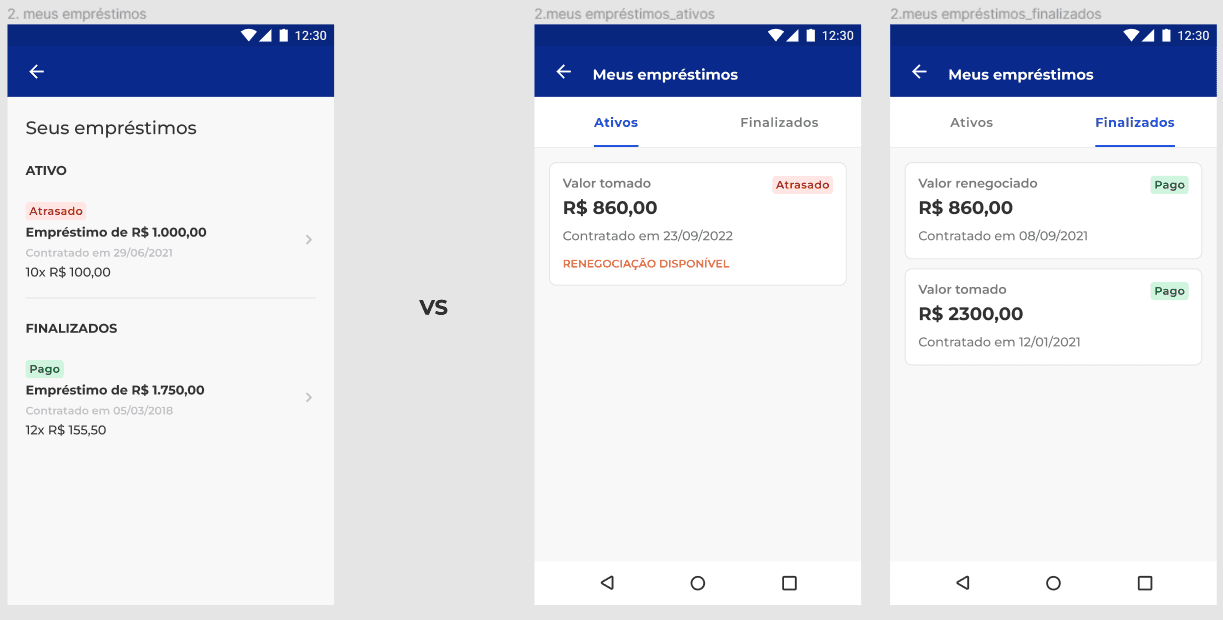

Reducing Misclick Rate and Helping Users Identify the Renegotiation Funnel

Within the renegotiation flow funnel, a particular screen experienced a significant decline in user engagement. The underlying hypothesis was that the availability of renegotiation options and the required action (clicking) were not clearly conveyed to users.

On the left is the original flow screen and on the right is my suggestion for improvement

To tackle this issue and enhance the user experience, the following improvements were implemented:

Emphasized Clickable Elements: The traditional list-based display of loans was replaced with a card-based presentation. Cards provide a more prominent visual cue and encourage clicking, making it easier for users to identify and initiate the renegotiation process.

Clear Renegotiation Availability: A badge was added to each card explicitly indicating the availability of renegotiation options for that specific loan. This clear visual indicator eliminates any ambiguity and guides users directly to the action they need to take.

Improved Value Identification: Leveraging insights from the questionnaire, the identification of the renegotiation value was refined to address the confusion it caused with the loan title value. To enhance clarity, the loan title was updated to include the category, either "Original Loan Amount" or "Renegotiated Amount," depending on the applicable scenario.

These changes aimed to provide a more intuitive and user-friendly renegotiation flow, reducing drop-offs and improving the overall user experience. By clearly communicating renegotiation options, emphasizing clickable elements, and providing clear value identification, users were better guided through the process, leading to increased engagement and successful renegotiation outcomes.

As a direct result of this specific improvement, we observed an 18% increase in the number of users successfully identifying and entering the renegotiation request funnel within the first 3 months following implementation.

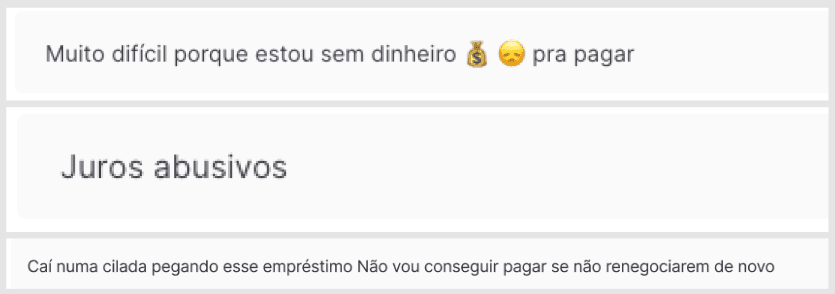

We opened up the survey for feedback and find out the root of the issue!

In my previous discussion about design-driven solutions that mitigate the friction between product business rules and user experience, I was referring specifically to the renegotiation flow improvements we implemented.

To illustrate the impact of these changes, I'd like to share three examples of user feedback we gathered through our survey. Upon further investigation, which included consulting our support team, app store reviews, tweets, and other relevant sources, we discovered that the lack of transparency and high renegotiation fees were the primary factors contributing to user dissatisfaction and potential non-payment.

Exemplos de comentários que recebemos sobre o serviço de renegociação

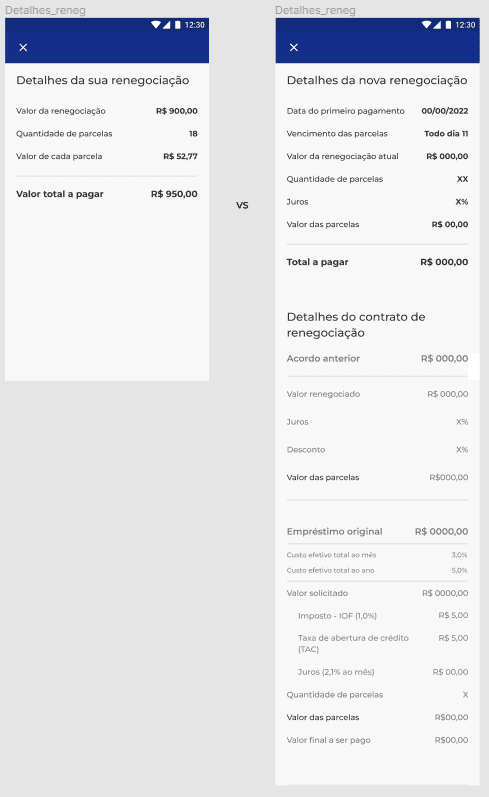

To enhance transparency, I opted to redesign the renegotiation details screen. This screen, which was previously only accessible within the renegotiation request flow, was also made available for users with active renegotiations. Prior to this change, users were required to consult their contracts for detailed information about their renegotiations.

To address the issue of non-payment, we introduced the concept of "renegotiation renegotiation," allowing users to request a new agreement based on their existing loan renegotiation. This feature aimed to further reduce the debt burden for our customers by aligning the repayment terms with their financial realities.

Key Points:

Enhanced Transparency: The renegotiation details screen was made accessible throughout the user journey, providing easy access to essential information.

Addressing Non-payment: The "renegotiation renegotiation" feature offered additional flexibility and support for customers struggling with debt.

Customer-Centric Approach: Both initiatives were driven by a deep understanding of user needs and a commitment to improving their financial well-being.

On the left the screen of the original flow and on the right my improvement suggestion

As a result of the research-driven implementations, our credit renegotiation conversion rate increased by 6%, while the drop-off rate between renegotiation request and completion decreased by 28% in the first quarter. Additionally, we introduced the "renegotiation renegotiation" feature, which proved to be a game-changer for our delinquent customers, reducing the delinquency rate from 64% to 31% in just 4 months.